Several of the major energy-producing states face economic pressures in the coming year from both the global virus outbreak and the oil and gas price…

Oil and Gas Industry Effective Tax Rates

Our recent research report on the effective tax burden across the 16 largest energy-producing states was just released and is available for download. The report extends the typical effective tax rate analysis to personal income and sales taxes to better account for vastly different overall tax structures across the producing states. These are also the two primary sources of tax revenue in Oklahoma.

Oklahoma Oil and Gas Industry Taxation – Comparative Effective Rates in the Major Producing States

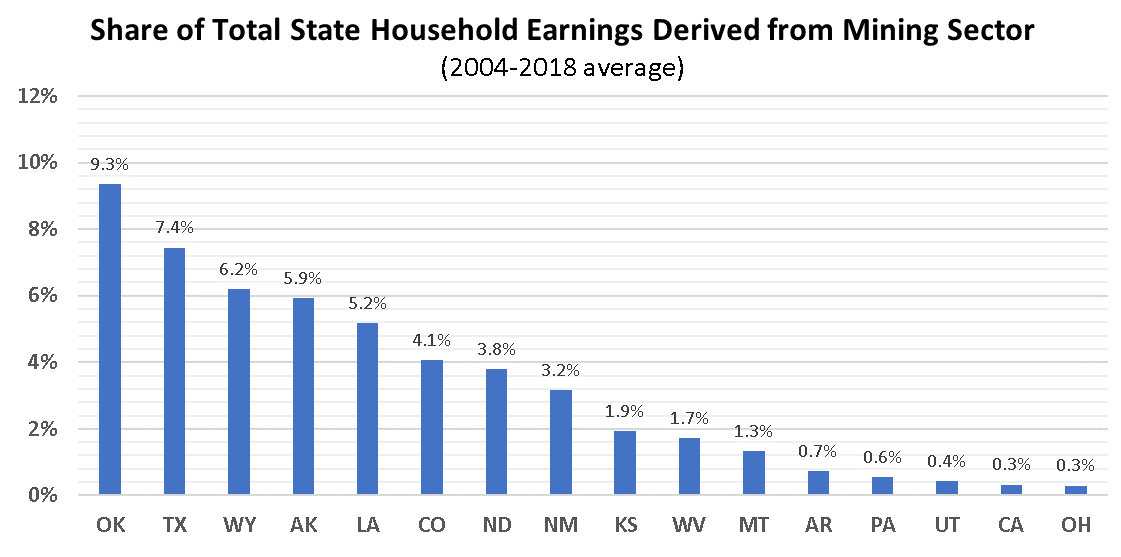

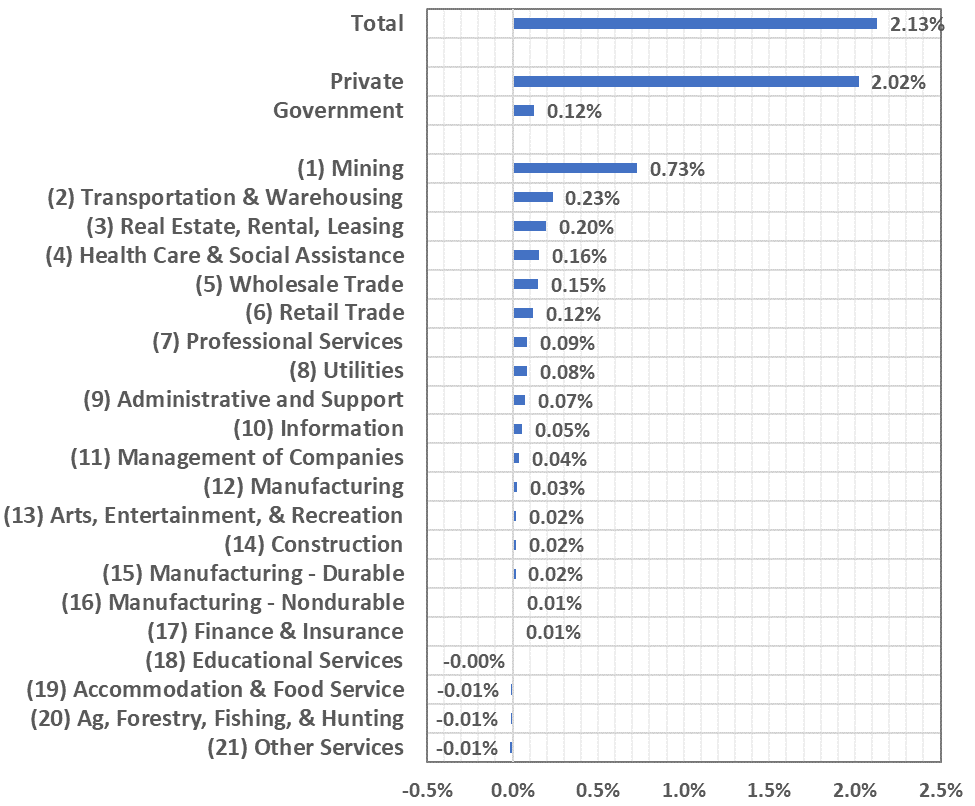

“This report provides estimates of the effective tax burden faced by the oil and gas industry in Oklahoma and fifteen other major energy-producing states. Evaluations of oil and gas tax burden are typically restricted to the role of severance taxes and ad valorem taxes related to oil and gas production. Data is readily available for these taxes and they capture much of the direct tax contribution from oil and gas production. However, these two tax streams do not capture the tax contribution of the oil and gas industry more broadly. The industry and its employees make significant contributions to several other major tax streams as well. In Oklahoma, the most important among these are personal income tax and sales tax, two of the largest sources of revenue to state and local government. Other smaller tax streams include corporate income tax, franchise tax, motor vehicle tax, and motor fuel tax.

When doing cross-state comparisons, the use of a narrow set of taxes can produce a grossly misleading view of the overall tax contribution of the oil and gas industry. The major energy-producing states assess a range of taxes and rely on them to varying degrees. Some producing states do not levy a personal income or sales tax and rely much more heavily on severance and ad valorem taxes to fund state and local government spending. Even among states that do levy income and sales taxes, the effective rates vary greatly. The size of the oil and gas industry varies as well, as states with a large oil and gas employment base receive relatively more tax revenue from the industry. Drilling-active states also tend to receive significant current tax revenue from increasingly capital-intensive wells relative to producing states with little drilling activity.

The purpose of this report is to provide a broader comparison of the tax burden faced by the oil and gas industry in Oklahoma. Estimates of the combined effective tax rate for severance, ad valorem, personal income, and sales tax are provided for Oklahoma and fifteen other major producing states. While this does not provide an exhaustive review of the total tax payments made by the industry, these taxes comprise the two largest sources of state and local taxes in Oklahoma and capture the major taxes typically derived from oil and gas drilling and production activity.

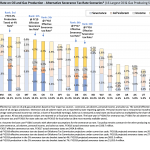

The findings of the report have important implications for Oklahoma policymakers setting tax policy in the state. While the FY2016 effective tax rate in Oklahoma ranks 12th among the 16th largest producing states based solely on severance and ad valorem taxes, the overall effective rate rises to 8th when personal income and sales taxes are considered. Many of the major producing states have either no personal income tax or very low sales tax rates, or both, and are heavily reliant upon traditional severance and ad valorem taxes to fund state and local government. Oklahoma, on the other hand, levies relatively low severance and ad valorem taxes but relies heavily upon above-average sales and personal income taxes paid by the industry.

More importantly, the recently implemented increase in the state’s severance tax rate is pushing the state’s overall effective tax rate on oil and gas production much higher this fiscal year and next. Based on Oklahoma Tax Commission forecasts, the severance tax rate increase is projected to push the state’s overall effective tax rate to 5th highest in the current fiscal year (FY2018), rising above the overall rate levied by dominant-producer Texas.

Further increases in severance tax rates would raise the state’s overall effective tax rate to among the highest levied by the major oil and gas-producing states. A scenario of shifting all projected FY2019 production in the 2% tax bracket to a 4% severance tax rate would give Oklahoma the 3rd highest overall effective tax rate. A scenario of shifting all oil and gas production in FY2019 to a 7% severance tax rate would give Oklahoma the 2nd highest overall effective tax rate among the sixteen largest producing states.”