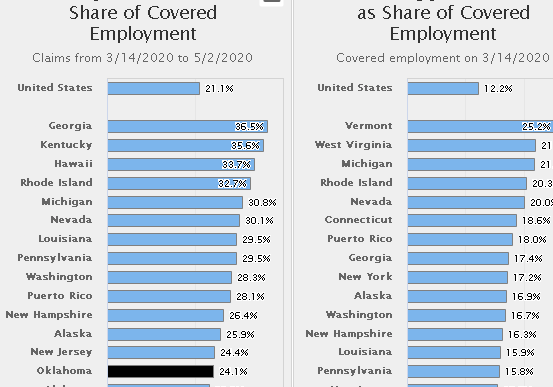

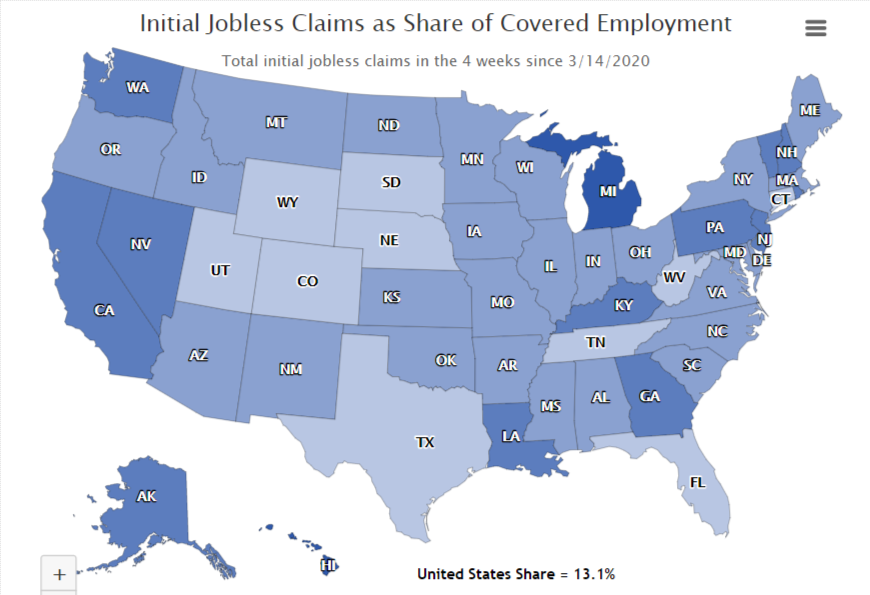

The Bad News You may be wondering where the good news is hiding given the string of bad news on Oklahoma unemployment claims so far…

U.S. Marginal Oil and Gas Wells Still Matter

The Interstate Oil and Gas Compact Commission (IOGCC) just released its 2015 Marginal Wells report detailing production from marginal oil and gas wells across the producing states. RegionTrack was once again pleased to assist them with compiling the report!

The IOGCC defines a marginal (stripper) well as a well that produces 10 barrels of oil or 60 Mcf of natural gas per day or less.

Key findings from the report include:

- Most operating wells in the U.S. in 2015 are marginal producers, including 69.1 percent of all oil wells and 75.9 percent of all natural gas wells. Overall, 72.2

percent of all operating wells in the U.S. in 2015 are marginal. - The 292.5 million barrels of marginal oil produced in the U.S. in 2015 represent 8.5 percent of total domestic oil production of 3.44 billion barrels.

- Marginal natural gas production in the U.S. totaled a reported 1.96 billion Mcf in 2015. This represents 6.8 percent of the 28.8 billion Mcf of natural gas produced domestically in 2015.

- The estimated value of marginal oil and natural gas produced in 2015 totaled $18.1 billion. This is nearly 50 percent below recent years and reflects historically

low prices for both oil and natural gas. The value of the 292.5 million barrels of marginal oil produced totaled $13.0 billion based on an average price of $44.40 per barrel. The 1.96 billion Mcf of marginal natural gas produced in 2015 is valued at $5.1 billion based on an average natural gas price of $2.62 per Mcf. - The recent collapse in crude oil prices placed tremendous pressure on U.S. marginal oil producing states. The average price for crude oil dropped 52 percent

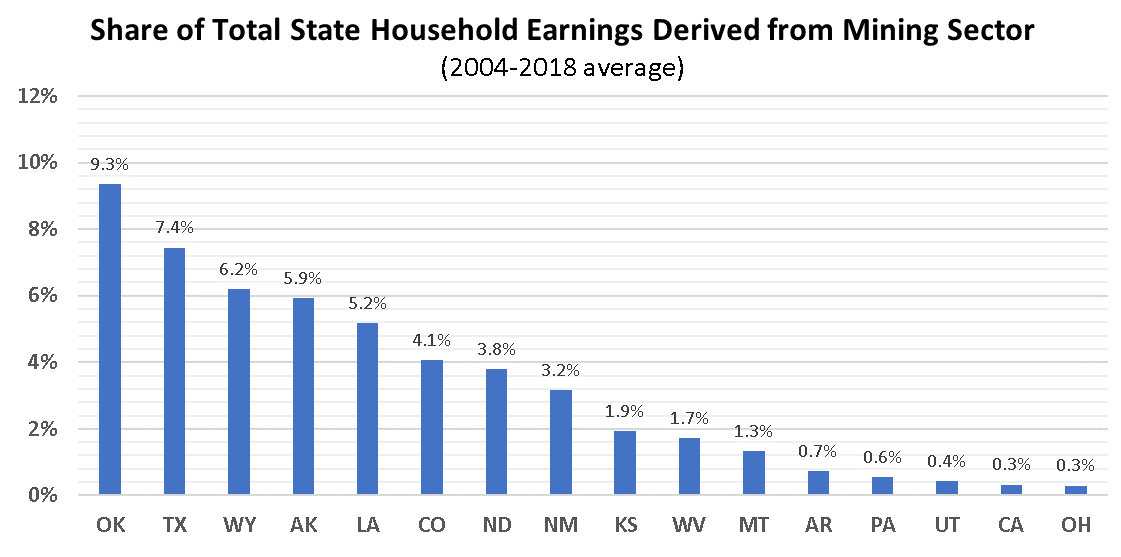

between the 2012 and 2015 survey periods, from $92.82 to $44.40 per barrel. As a result, the value of U.S. marginal oil produced dropped by about half (49.4 percent) from $25.6 billion to only $13.0 billion. - Including spillover losses, the impact of the drop in crude oil prices on economic output is heavily concentrated in seven of the largest marginal oil producing

states. These include Texas (-$8.4 billion), California (-$3.3 billion), Oklahoma (-$1.2 billion), Colorado (-$1.0 billion), Kansas (-$1.0 billion), Louisiana (-$956 million), and New Mexico (-$956 million), all with output declines of roughly $1 billion or more. Two additional states – North Dakota and Illinois – suffered a total estimated decline in the output of goods and services of more than $500 million.

Download the full report.